8.21.2024

The latest news out of China is, of course, all bad. Bank lending is at a 15-year low and Wal-Mart has sold its stake in e-commerce platform JD.com. Also, the EU has signficiantly reduced the tariffs on Chinese-made EVs—but only the ones named Tesla. Ergo, more ammo for The Wall Street Journal’s and Bloomberg’s dunking campaign on the Middle Kingdom, which is always on the precipice of collapse, and plenty of their readers believe it. This will not end well for the media’s snakes but China, the original honeybadger nation, will be fine. Because they don’t give a shit about narratives. Should investors?

In other words, To invest or not to invest? Which is not a conundrum to be litigated in opinion columns, this one included. Investors in China, myself one of them, have taken some punches in the few years since the government abruptly kibboshed Ant Group’s IPO, supposedly because its founder, Jack Ma, had overstepped. In authoritarian states, one does not become more famous than the great leader, which was discussed here on Sunday vis-a-vis Prince Alwaleed and MBS. In the U.S. and Europe, business runs Washington. Not so China and Saudi Arabia and many other places. Whether this makes them uninvestable is subjective, though I doubt that is what’s scaring foreign investment away from China and into Saudi Arabia.

The tale of the world’s two major economies, indeed the world’s two major hemispheres, is a clash of cultures. Westerners have become increasingly self-centered (individualistic is the nice word). The young are told that the world should be a mirror rather than a window. In popular culture, what matters most, and sometimes at all, is your emotional state at any given time. The greater good (or bad), not so much. You do not adapt your perspective, rather the world must adapt to your perception of self. For example, there was news this week of a woman who interviewed the actress Blake Lively and came away offended. Why? Lively mistook the interviewer’s tummy for a baby bump; to make matters more awkard, the woman is apparently infertile. Naturally the interviewer has made herself the story now. On the Internet, she awaits an apology. Amazing that she has not called the police because she clearly considers herself a victim of violence, in some European countries Lively could probably be jailed. Which is not what the interviewer probably wants, what she wants is fame, for this slight to elevate her to celebrity. Who cares about the interview itself, i.e. her job, when her feelings have been unjustly hurt?

My experience is that Asians, Chinese included, do not appreciate this perspective, or even understand it. Also they do not care to understand it. This may be hurtfully shocking and even barbaric to a lot of Westerners who long assumed that because Chinese ate KFC and carried around Starbucks Coffee cups and iPhones and Birkin bags, well, they were becoming Westernized. These Westerners saw themselves reflected in China and that made the Chinese investment-worthy. (The Chinese are just like us! They shop at Wal-Mart!) But now the Chinese are ditching American brands and American movies and what seemed like a mirror has revealed itself a window to a complex and often inscrutable culture.

Of course this was entirely predictable, especially when the media began to parrot political antagonism of the Chinese, 24/7. But the main question lingers: invest or no?

Months ago, maybe longer, I published a map of countries that had defaulted on their debts and/or devalued their currencies in the recent past. These, I wrote, were the uninvestables, and I still think that’s not a bad rule of thumb because it’s quantitative. But it does not leave that many places to invest and China happens to be one of them. (I am not in the mainstream here, apparently, as reports say the new carry-trade is converting dollars to the currencies of countries on my no-go list.) This makes investing in China essential. It helps that American stock markets’ relentless rise has priced investors out of stateside stocks en toto, meaning American index funds and ETFs.

As Charlie Munger observed shortly before his death, China is where the fishing is nowadays.

Not because there are no fish in the old familiar ponds, he said, but because those have become stagnant, especially with the rise of private equity and the dearth of IPOs—still except upon the surface, where there is frenetic activity in rancid stuff like derivatives and crypto and meme stocks and on and on. But investors don’t buy things that have no intrinsic value. They don’t dance on the surface, as spectators do.

In China the surface appears to be still, frozen and on the verge of cracking to the folks at the Journal and Bloomberg, but below is a different story. Some of the activity is fish eating one another, but Chinese commerce is not all destructive. Unlike most advanced economies, China has a deep well of manufacturing and savings upon which a thinner layer of consumption and financial activity is forming. In the swells below the surface, there are races to the top as well as the bottom. Xi call the Chinese economy dual circulation, though it’s more than that. It’s a race to add value, to get to the top of the economic food chain and remain there for centuries. Which explains the fear.

People I know and respect will acknowledge what China has achieved then counter that the Chinese can’t be trusted. But what if they’re just like us except for the being very good at math and saving money? I counter. China’s a big, complicated place so maybe both of these are true—say, if you ascribe the mendacity to the Communist Party, of which the vast majority of Chinese are not members, and the industriousness to the Chinese people. Are we so different?

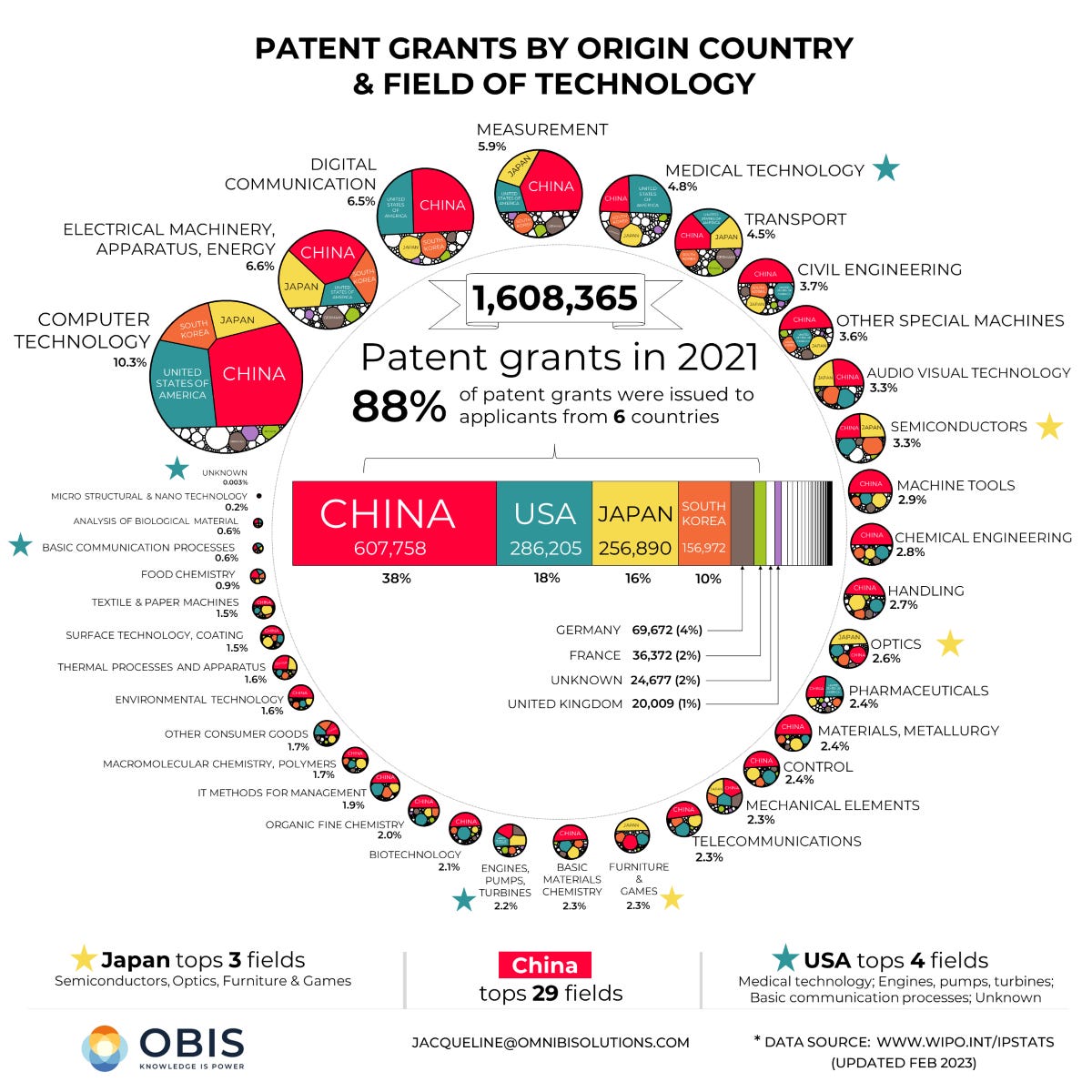

Yes, say Bloomberg and The Journal; all Chinese people are beholden to the Communist Party so what’s the difference? Fair enough, but this is like conflating half of Americans with Donald Trump and the other half with Joe Biden or Kamala Harris. In other words, it’s a double standard that ignores the daylight between all governments and their people. The Chinese are now making their own airplanes, while Airbus dithers and Boeing crumbles. And they are making their own semiconductors, while Gina Raimondo sniffs that they are years behind us in some esoteric sense. They are dominating green energy, while Ford just abandoned making a single electric SUV.

True, there’s a lot of unprofitable Chinese ADRs littering the American stock markets, so many in fact that the NASDAQ is promising to crack down on Chinese listings. I hope they do but why stop with the Chinese? Let’s stop foisting companies that will never make a dime into toxic index funds and ETFs. Let’s avoid another Global Financial Crisis. Please?

Hypocrisy, says one prominent though unctuous Hong Kong columnist I’ve been tracking, is America’s gift that keeps on giving. A gift because Chinese people, Communists or not, tend to be very interested in geopolitics and international business, especially the younger ones. No doubt state-owned media sets the talking points and social media, monitored by the government, amplifies every dumb thing Donald Trump or Joe Biden or Kamala Harris says. But we are handing them the propoganda at this point. And it has galvanized Chinese engineers and workers to be better than us and Chinese consumers to ignore us. Hollywood is no longer cool. Once dominant brands like Starbucks, Nike, Buick and KFC are flagging. The iPhone is no longer a top five player in market share in the world’s largest smartphone market. You don’t have to be a mandarin to see where this is going, do you?

On a visceral level, most investors probably understand China’s importance, if only because they are watching their beloved American stocks suffer the consequences of trade wars and decoupling and fear. But most of these people cannot or will not overcome Bloomberg’s and the Journal’s narrative, they will fight patriotism with patriotism I guess, so now they’re pouring money into Japan, an ally, where foreign investment is up a reported 70% this year. But this is in large part because China is Japan’s largest trading partner—a pass-through in other words, or a workaround if you prefer. Well, that’s kind of clever but the Japanese are also an aging population and even the young people tend to do things at a glacial pace so good luck with Japan, I guess.

Meanwhile the 1.4 billion Chinese know they are ascendant, and when manifest destiny calls, all you have to do is not hang up. So while Western politicians relentlessly blame China for their own problems, the Chinese government focuses inward, as ever, addressing the major threats to stability: intractable corruption, social media, giga-wealth inequality and tariffs, most prominently. Because stability trumps growth. Chaos is avoided by snuffing calamities and guess what? It works. The Chinese stock market is not nearly as big and dynamic as the US but it has been more stable, avoiding the dramatic crashes, and as a result the Shanghai Index to post annualized returns, exclusive of dividends, of 9.9% since January of 1991 (below) versus 8.4% for the S&P 500. In other words, one million dollars invested in Chinese stocks thirty years ago would now be worth about $17 million, versus just over $11 million in the US. (I use 1991 because it’s the first year available for the Shanghai Exchange.)

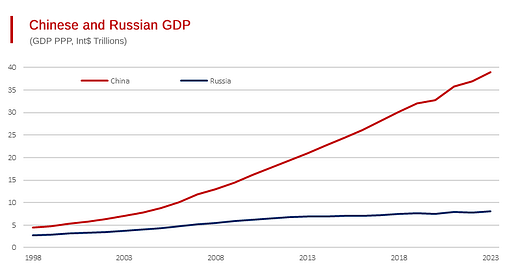

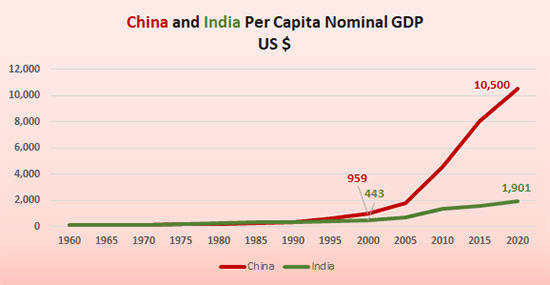

Xi has demanded a world-class stock market in the next decade or so. And who wants to bet against him when the window to the future looks like this:

You know who? People who don’t like windows, but mirrors. The Journal, for example, which ran its latest sky-is-falling-on-China piece just a couple of days ago, in which it advised its readers thus:

…there is a lack of promising investment options. China’s CSI 300 index, which tracks the biggest stocks listed in Shanghai and Shenzhen, is down 3% this year after three consecutive years of losses. The property market, which used to be the most popular form of investment for Chinese households, remains in doldrums. New home prices in 70 major cities dropped 5.3% in July from a year earlier.

In other words, China’s economy is still among the fastest-growing in the world, even as interest rates and inflation remain subdued, and even as China has become the world’s largest market for most things and the world’s second largest economy in dollar terms. Yet asset prices are the lowest in years right now. Sounds like a market inefficiency, not a death knell, but I’m no journalist.

####