FYI: GrahAmerica is now The Intelligent Newsletter. (It’s aspirational!) To receive House Money and the 40s Indexes every Sunday, click the button.

15/20:

Q: What is fundamental?

A: Human nature.

The two most bewildering words in the investing lexicon are value and fundamental and I wonder if this is an accident. Probably not! Value, for example, is a relative term but it’s used to denote an absolute, e.g. “value stock.” Fundamental is an adjective that has been co-opted into a noun, e.g. “market fundamentals.” (The noun fundamental is, by long tradition, a technical musical term.) Compounding the confusion is that, in its bastard investing-noun form, fundamental signifies 1) the aspects of a company or market that are least subject to change; or 2) any financial metric deemed important by virtue of being named a “fundamental.” Yet financial metrics seem to get “adjusted” all the time, as in from earnings call to earnings call. As do “the numbers” themselves, obviously. So “fundamentals” are really just temporary, fungible numbers masquerading as permanent values.

Anyhoo…

Ben Graham, a conscientious proprietor of language, thought a good deal about what might be considered fundamental, if anything, in terms of a successful and durable investment strategy. His conclusion was ultimately affirmative, the fundamental element being an alignment with human nature.

The human nature of the financial pages is exclusively of the negative variety: fear (or FOMO if you prefer); rage; jealousy; greed and ego. For example, Reddit mobs, Elon Musk and David Portnoy have collectively provided a master-class in our worst instincts over the last several weeks and no one seems very surprised. Now that the /WallStreetBets movement has moved its messaging onto billboards, the better for the Dogecoin pack to battle the Bitcoin Bros and the faithful to shame the weak and so on and so forth, we non-Redditors/Tweeters/YouTube day traders will receive a lesson in inevitability, i.e. the transformation of greed into desperation, though I’m not sure that desperation is as intrinsic to our nature as it is to modern living, which feels more and more like the first Transformers movie, whose tagline was “Our World/Their War.” I’m no sociologist but allow me this: That the “democratization of investing” = Animal Farm kind of proves Graham’s point.

But Graham would never dwell on the negative, like the rest of us—or maybe it’s just me? His favored human traits were generosity, creativity and foolishness. Rather than throw up his hands at the fault in ourselves, or dunk on his targets, or mean-Tweet or whatever, Graham proffered several specific, and he must have hoped, constructive, criticisms of our inner selves:

1. Everyone thinks of themselves as a contrarian, especially those in the middle of the herd.

2. Gamblers always believe that the odds are in their favor.

3. People are compelled to express an opinion about things about which they know nothing and over which they have no control.

4. If someone else expresses an opinion about something about which they know nothing and over which they have no control, we tend to believe that this person must have some special insight that we ourselves lack.

What fools these mortals be! and so on. Except for Graham, naturally, who spent his life honing the most essential nature of all: empathy.

Speaking of master classes, I am teaching my valuation class this Sunday at 3 p.m. EST (12 p.m. PST, etc., etc.) via Zoom. Click here to enroll via PayPal. A Zoom invite/link will follow shortly. Cost: $49, refundable. Bring your valentine. Or a drink. Or maybe your valentine is a drink? No judgment here, just numbers…

the last 24 hours (or so)

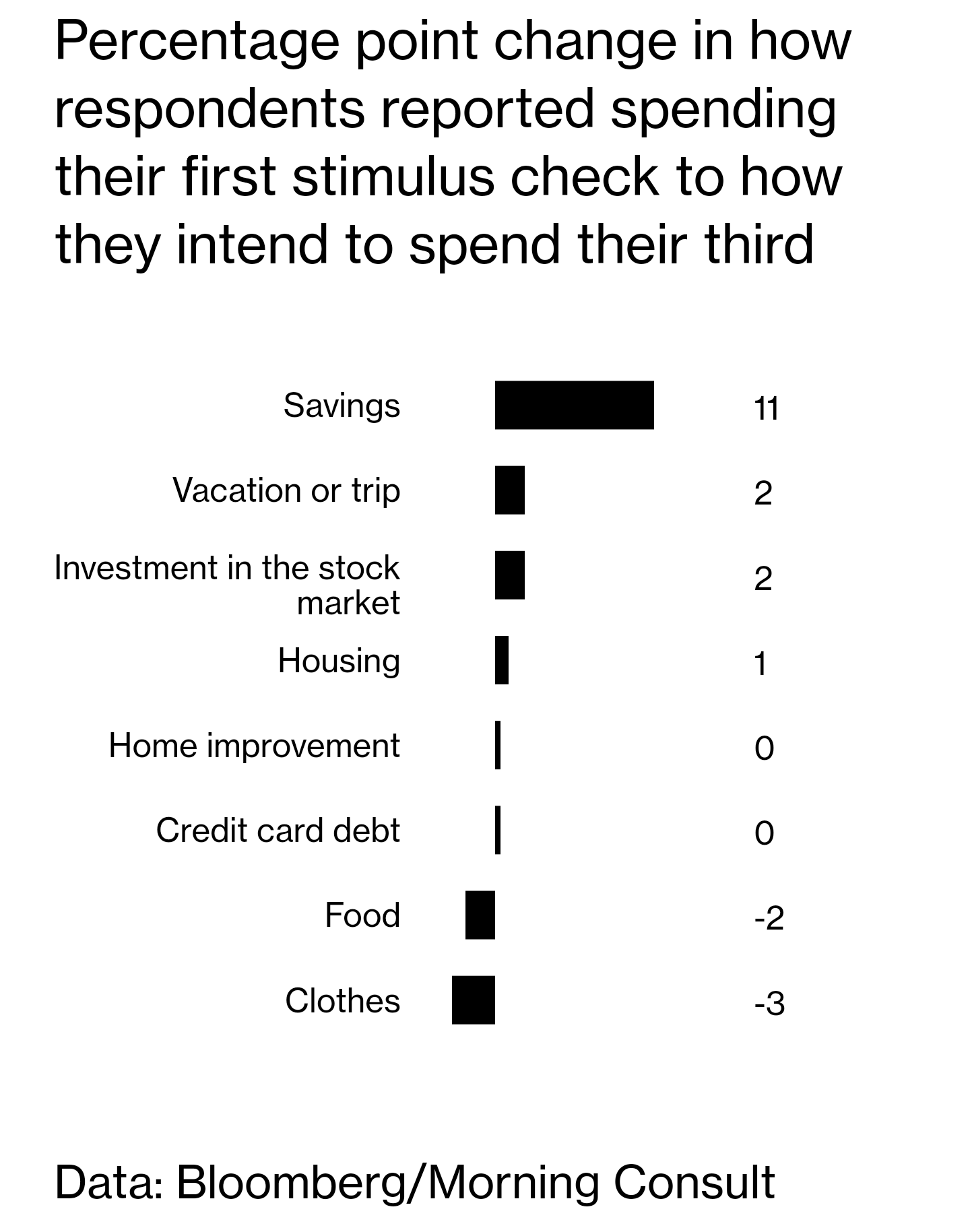

· Congressional leaders hope to see the third COVID-related stimulus package signed into law by March 14th, and promise it will include a $15 federal minimum wage. (CNBC)

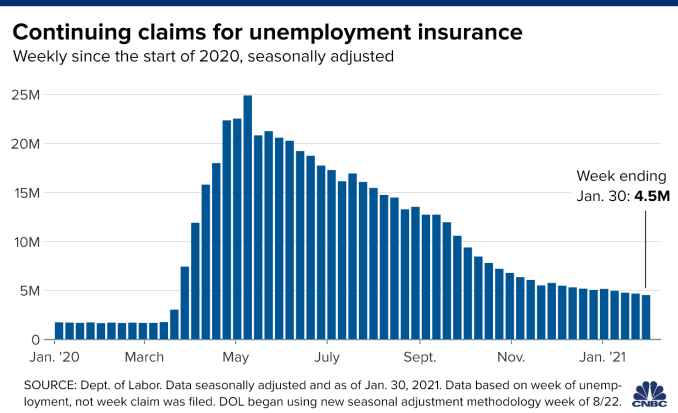

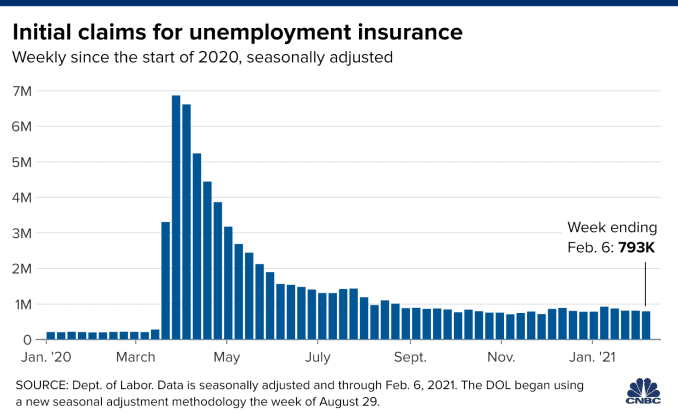

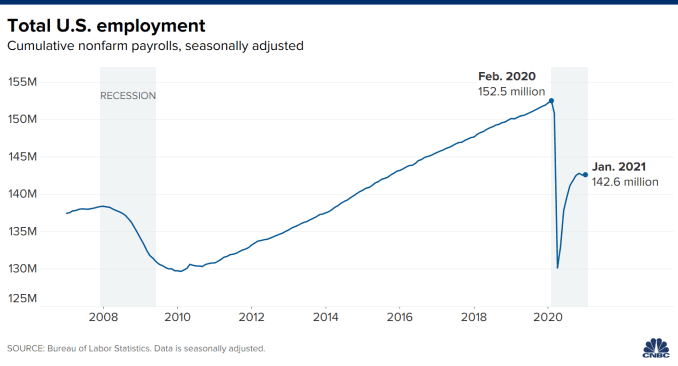

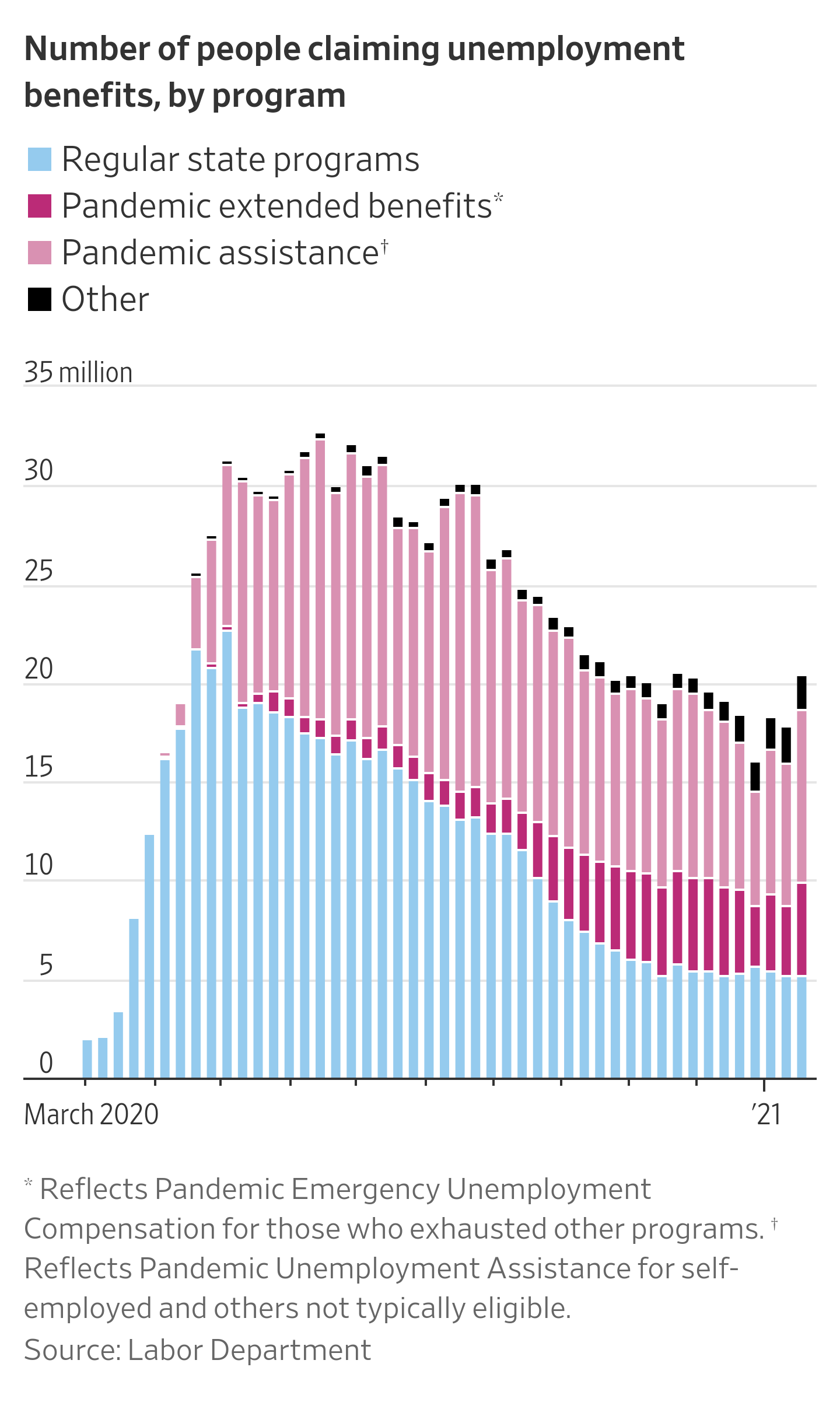

· Initial claims for state unemployment benefits fell 19,000 to 793,000 for the week ended February 6th, which is roughly four times the pre-pandemic level. (Reuters)

· The federal budget deficit is projected to be $2.3 trillion in fiscal 2021 (not including additional stimulus) which is on top of a $3.1 trillion deficit in 2020. The national debt is projected to surpass $35 trillion in ten years, at which time the ratio of debt to GDP will then be the highest ever. (Congressional Budget Office)

· In the fourth quarter, 161 U.S. metro areas posted double-digit increases in home prices, up from 115 metro areas with double-digit gains in the third quarter. (National Association of Realtors via The Wall Street Journal)

· The UK economy shrank 10% last year—the largest recorded drop since 1709. (BBC)

· Federal law enforcement authorities are investigating potential financial crimes vis-à-vis the stunning rise, then fall, of GameStop, AMC and other stocks. (New York Post)

· Robinhood clients have traveled to the company’s California headquarters in recent weeks to personally voice their frustrations, and – in at least one case — throw poop. (Forbes)

· More than 159 million doses of COVID vaccine have been administered in 76 countries. 48 million jabs occurred in the U.S. as of yesterday. (Bloomberg)

· The CDC now recommends double-masking to slow the spread of COVID. (Wired)

markets

Note: The markets will be closed on Monday in observance of President’s Day, so I’ll be sleeping in…

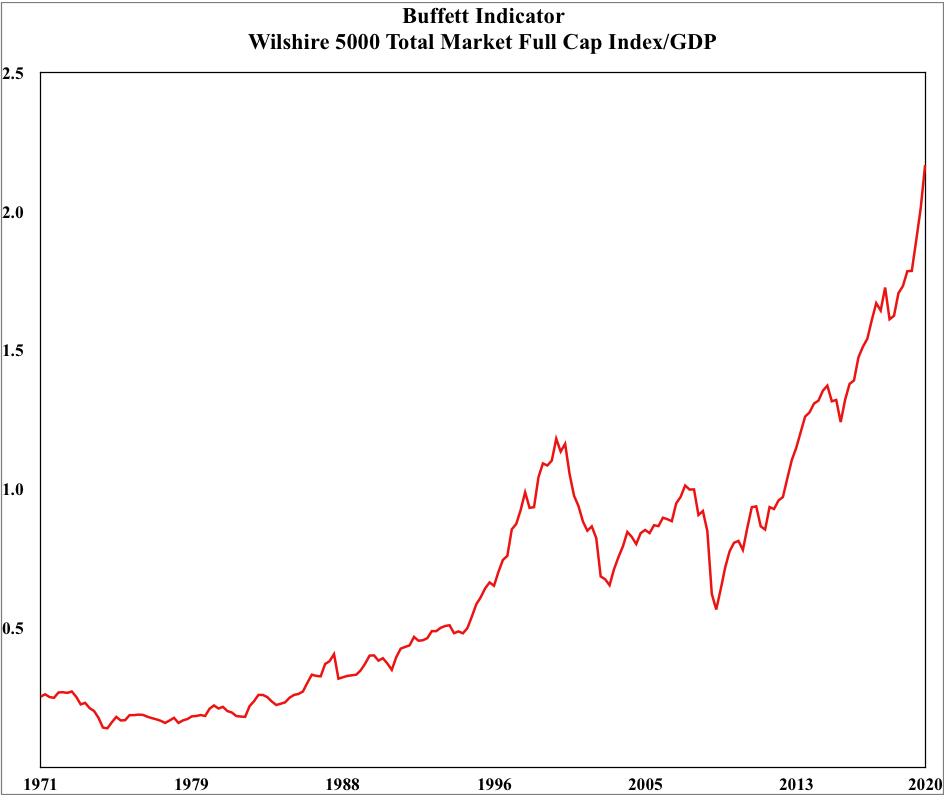

As of early this morning, the DJIA trades at a 37% premium to its quantitative value (QV*); the S&P 500 at a 38% premium; the NASDAQ Composite at a 33% premium; and the Russell 2000 +105%(!) Our estimated bear-to-bull-market trading ranges are given below.

DJIA: 15303 (low) to 34261 (high)

S&P 500: 1892 (low) to 4236 (high)

NASDAQ Comp: 7020 (low) to 15717 (high)

Russell 2000: 750 (low) to 1680 (high)

e-valuations

Our mission: to value each of the 7,000 or so issues listed on the NYSE and NASDAQ exchanges by year’s end. Behold today’s tranche of 25 stocks, chosen alphabetically from the Russell 1000. Quantitative values, aka QVs, are in parentheses. These are currently over-priced an average 28% versus their average QV*.

Symbol (QV): PEN (38); PBCT (18); RLGY (37); RP (41); O (56); RBC (181); REG (48); REGN (808); RF (17); RGA (211); RS (80); RNR (138); RSG (48); RMD (143); RPAI (4.8); RNG (11); RHI (61); ROK (195); ROL (14); ROP (220); ROST (46); RCL (39); RGLD (36); RES (2.5); RPM (47)

*QV is not a definitive measure of total value, rather a measure of demonstrable value based past financial results audited by a reputable firm. A material difference between QV and quoted price demonstrates qualitative market bias, which may be warranted. Or may not.

新年快乐